| HOME | NEWS | TRAVEL | PICTURE | CULTURE | VIDEO |

| English>> news | ||||

|

||||

|

||||

|

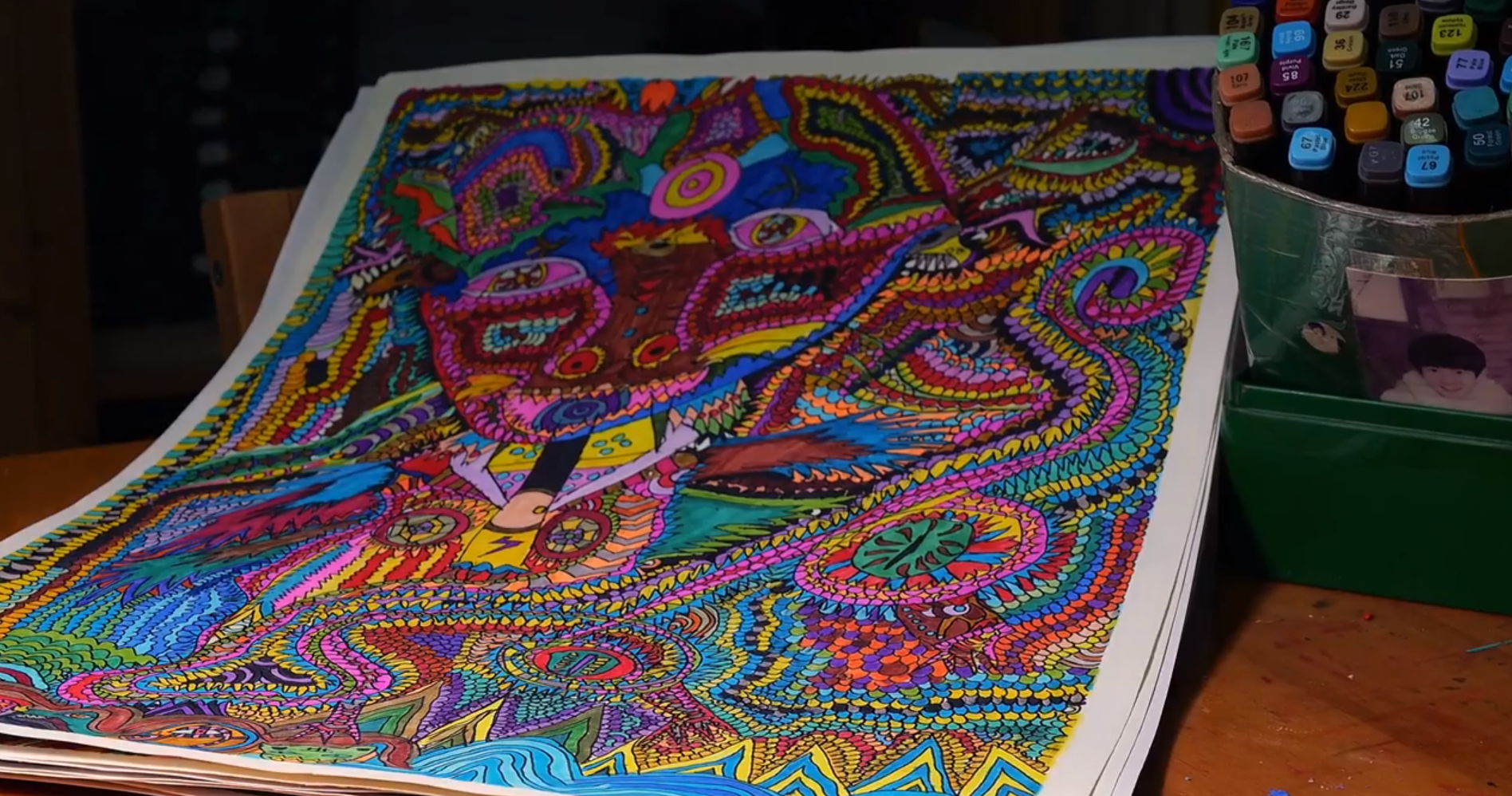

Chinese artist uses outsider art to assist people with mental disabilities U.S. San Diego Zoo shares first-look photos of two pandas from China Pear Blossom Deqin was transformed into a magical fairy tale world. Yubeng Village in Snow Xiaozhongdian Town celebrate Dala Farmers' Harvest Festival Common Redshank Diqing Specialty Cuisine The Secret Realm Meili Fashion show is staged under the Meri Snow Mountain Autumn view of Wudi Lake Stellera Flowers blooming on the grassland Xiaozhongdian Town: Singing and dancing to celebrate Dala Farmers' Harvest Festival. Black Drongo Shangeri-La Discovered Isoetes hypsophila the 24 solar terms|The Tibetan anchor of Diqing Daily spoke of the solar terms :Cold Dew Lotus flowers are blooming in Gran Village, Shangjiang Township the mountains and forests of Shangri La are blazed with color the 24 solar terms|The Tibetan anchor of Diqing Daily spoke of the solar terms :Cold Dew Autumn view of Wudi Lake |

||||

|

||||

|

Supervised by Publicity Department of the CPC Diqing Prefectural Committee; Run by Diqing Daily Copyright @shangri-lanews.cn; All rights reserved since 2008 Reproduction without permission is prohibited. IPC license numbers: 09000927-1(provincial); 53120170008 (national) No. at local police: 53342102000007 Tel.: 0887-8881015 E-mail: 70835107@qq.com | ||||

7740f3b5-9ecb-438e-9052-76cb2d4bb671.jpg)